Product Lineup

Our company has a track record of developing and delivering innovative solutions that enhance the performance and efficiency of the banking and financial institutions.

Creditx Pro

Credit X is an end to end application for loan management with system driven risk assessment, paperless appraisals, document management and document generation. With features like customer relationship management, direct loan application, reporting and auto loan disbursement and servicing, Credit X addresses the need of the end consumers as well as internal staffs in all touchpoints of customers.

Features

- Credit automation

- Risk assessment automation

- Document management

- Loan tracking and reporting

Creditx Micro

Credit X Micro is a lending automation solution catered to the needs of microfinance institutions. With seamless connection with core banking systems, time taken for credit underwriting process is significantly reduced so that loan officers can focus more on customer service and less on paperwork. Credit X takes care of generation of documents like offer letters and legal documents or any other template based document. In addition, disbursement and fund management is also made automated. The system can also classify customers based on risks factors for dynamic pricing. Advanced reporting generated in the system aids the management further for decision making.

Features

- Credit automation for microFinance

- Document management

- Document generation

- Loan tracking and reporting

Instaloan

Insta Loan is a micro credit loan disbursement engine which helps to lend micro credit instantly to customers based on dynamic engine that processes 100s of data points. This is fully system driven process that, with time, calibrates itself to optimize the default rate, eligibility parameters and risk weights.

Features

- Instant loan for customers

- High value loans

- Analysis based loan applications

- Eligibility based on various points

Remit Loan

Remit Loan is a micro credit loan application and processing system with capabilities to offer loan products to beneficiaries in Nepal of remitters abroad. The algorithm to process the eligibility of loan analyses various data points. Eligible customers are offered loan by the system based on various rules. In addition, customers can apply for remit loan through various channels like web, sms and mobile.

Features

- Developed for migrant workers

- Eligibility based

- Analysis based loan applications

- Eligibility based on various rules

Memo Management System

MMS or memo management system is developed for effective memo related decisioning and workflows. With MMS, the process to make and approve the memos become faster, efficient, time saving and secure. With dynamic workflows and user management, any type of memo can be processed by the system.

Features

- Memo workflows

- Faster alternative to manual systems

- Approval tracking

- User management for easier access

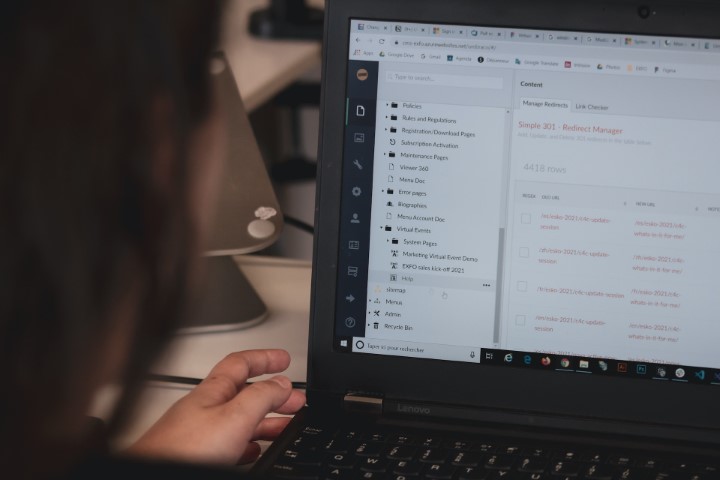

Document Management System

A Document Management System is lighter version of loan management system that lets users store documents and process loan through custom workflows, approval process. The system ensures proper record keeping, loan related tracking and reporting in a light and agile system.

Features

- Upload and storage of loan documents

- Workflow and approval process

- Saves time and money

- Loan tracking and reporting

Online Account Opening Application

This module replaces the conventional account opening process by fully digitizing the application process. The data on the online forms are validated to mitigate the chance of errors or incomplete application. All the applications can be managed centrally or processed through workflows.

Features

- Digitization of account opening

- Easy data validation

- Mitigation of errors and incomplete applications

- Application approval workflow

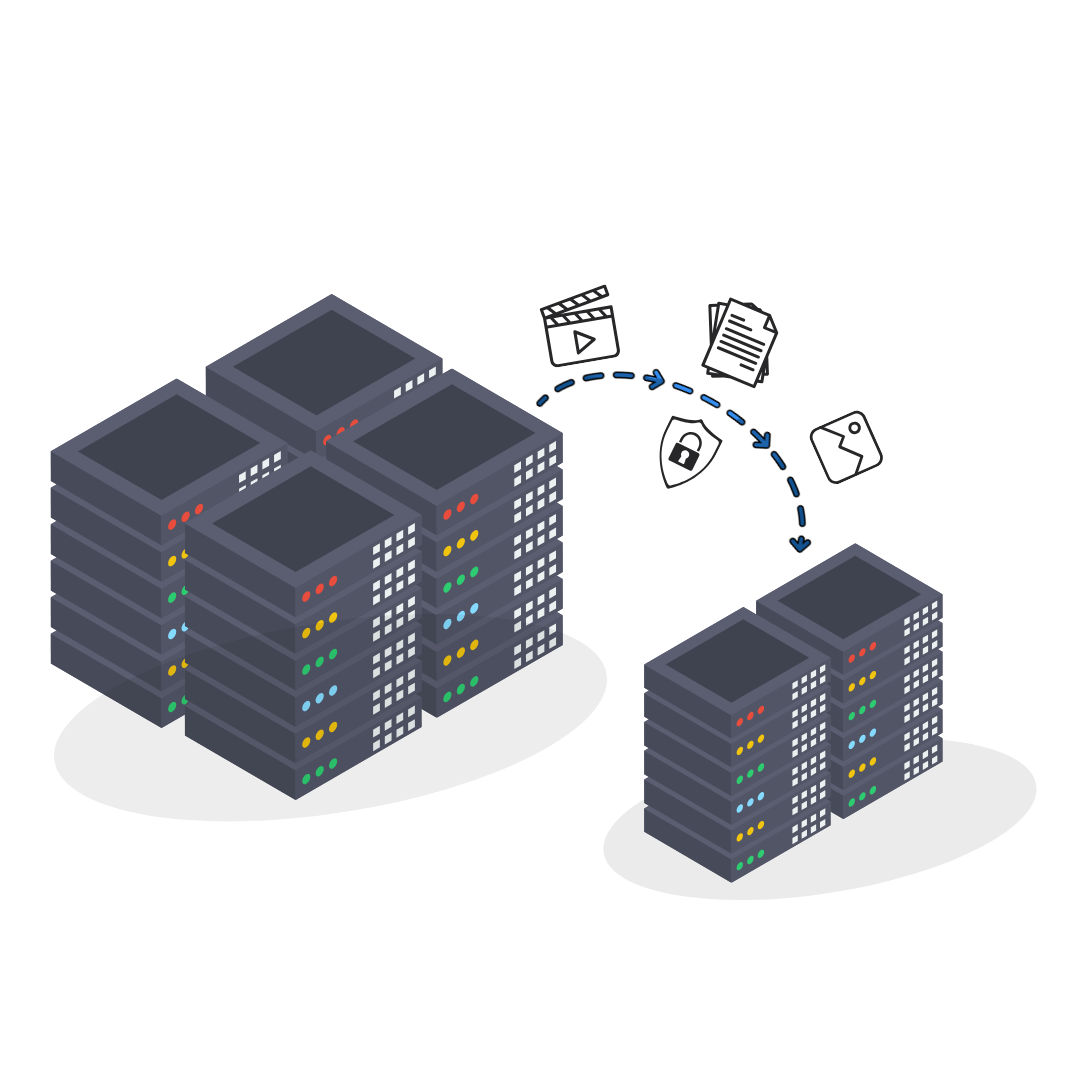

Document Compression System

Streamline your document compression with our versatile system offering UI-based, server path-based, and API-based compression. Customize configurations, manage users efficiently, and enjoy admin features like compression limits, email notifications, and detailed logs for actionable insights.

Features

- Data privacy compliance for sensitive industries.

- Compress file sizes by up to 80% for PDFs, images, and videos.

- Fully secure, in-house solution—no third-party involvement.

- Enterprise-grade compression with zero quality loss.

Office IVR System

An Interactive Voice Response (IVR) system is an automated telephony technology that interacts with callers, collects information, and routes calls to appropriate agents or self-service options. IVR systems allow businesses to manage high call volumes efficiently, enhance customer experiences, and reduce operational costs

Features

- Automated Call Handling

- Self-Service Options

- Call Routing

- Integrates with CRM for personalized customer responses.

HR/Inventory & Fixed Assets

Streamline your workforce operations with HRMS, a comprehensive and scalable solution designed to enhance HR efficiency and employee satisfaction. Automate routine tasks, improve data management, and support informed decision-making with real-time insights

Features

- Employee lifecycle management

- Self-Service Options

- Real-time attendance and leave tracking

- Integrates with CRM for personalized customer responses.